The Latest Safety Incident Sends Southwest Airlines Stock Into Turbulence

Southwest Airlines stock is facing uncertainty on Monday after a troubling safety incident involving one of its Boeing 737s. The Federal Aviation Administration (FAA) reported that during takeoff, an engine cover detached from the aircraft and struck a wing flap. This incident occurred on Southwest Flight 3695 at Denver International Airport, prompting the plane to return to the gate for further inspection. Passengers were safely transferred to another aircraft to continue their journey to Houston’s William P. Hobby Airport.

Recent Safety Concerns

This latest mishap adds to a series of safety incidents that have plagued Southwest Airlines in recent months. Just days before this incident, an engine fire forced one of the airline’s planes to abort takeoff in Lubbock, Texas. Additionally, in March, a Southwest plane veered off course during landing at New York’s LaGuardia Airport, narrowly avoiding a collision with an air traffic control tower.

These incidents have raised concerns about the airline’s safety protocols and maintenance practices. Southwest Airlines has not confirmed when the affected plane last underwent maintenance but has assured that its maintenance teams are investigating the issue. The FAA is also conducting its own investigation into the incident.

Boeing’s Role in the Incident

Southwest Airlines exclusively operates Boeing 737 narrow-body aircraft, which have been under increased scrutiny following a series of safety issues. In January, an Alaska Airlines 737 Max 9 experienced a midflight incident where a door plug blew off, leading the FAA to halt Boeing’s 737 Max production until quality control concerns were addressed.

Southwest’s reliance on Boeing aircraft has also been impacted by reduced jet deliveries this year, leading the airline to revise its current-quarter and full-year outlook due to decreased capacity. These factors have contributed to the downward pressure on Southwest Airlines stock.

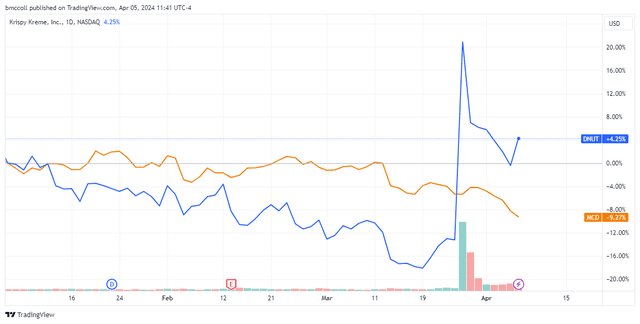

Technical Analysis of Southwest Airlines Stock

From a technical perspective, Southwest Airlines stock has been in a downtrend since falling below the 200-week moving average in July of last year. Investors are closely watching a key trendline dating back to May 2021, as a breach of this level could signal further downside potential.

If the stock fails to hold above this trendline, it may retest the November 2023 low around $22.70. On the other hand, a breakout above the trendline could encounter resistance near the July 2023 countertrend peak of $38. These levels also align with significant support and resistance areas from the pandemic era.

As of the latest data, Southwest Airlines shares closed at $28.34, down 19% from their year-to-date high set in March. The stock’s performance in the coming days will be closely monitored by investors and analysts alike.

Conclusion

The recent safety incident involving Southwest Airlines has once again brought attention to the airline’s operational challenges and maintenance practices. With ongoing investigations by both the airline and regulatory authorities, investors are closely monitoring the stock’s performance and technical indicators for potential trading opportunities.

As Southwest Airlines navigates through these turbulent times, stakeholders will be looking for clear signs of improvement in safety standards and operational efficiency to restore confidence in the airline’s future prospects.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as investment advice. The author does not hold any positions in the securities mentioned above.