Johnson & Johnson Acquires Shockwave Medical for $13.1 Billion

Johnson & Johnson (JNJ) made headlines recently with the announcement of its acquisition of Shockwave Medical (SWAV) for a whopping $13.1 billion in cash. This move is set to significantly boost J&J’s presence in the cardiovascular intervention market, marking a strategic expansion in the healthcare giant’s portfolio.

The Deal Details

The purchase price of $335 per share represents a 4.7% premium over Shockwave’s closing price prior to the announcement. This acquisition is part of J&J’s broader strategy to strengthen its position in the fast-growing cardiovascular intervention market, which is characterized by substantial unmet patient needs.

One of the key assets that J&J gains through this deal is Shockwave’s intravascular lithotripsy technology. This innovative catheter-based treatment is designed to address calcified arterial lesions, a common issue that can lead to reduced blood flow, pain, and even heart attacks. By incorporating this technology into its existing cardiovascular portfolio, J&J aims to enhance its ability to provide comprehensive solutions for patients with heart-related conditions.

Strategic Expansion in Healthcare

This acquisition comes on the heels of J&J’s previous purchases of Abiomed and Laminar, both of which focus on developing products to assist individuals with heart issues. By adding Shockwave Medical to its roster, J&J is further solidifying its position as a key player in the healthcare industry, particularly in the cardiovascular space.

With the transaction expected to close by midyear pending approval from Shockwave investors, J&J is poised to leverage its financial resources and expertise to drive growth and innovation in the cardiovascular intervention market.

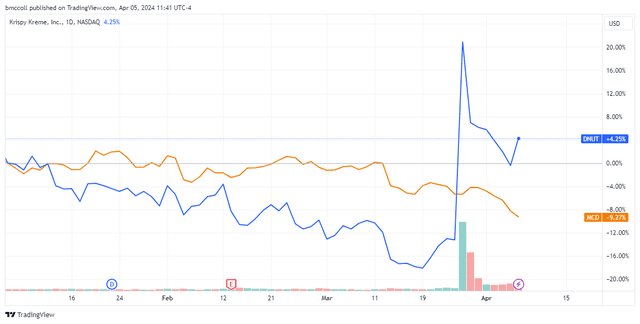

Market Response

Following the announcement of the acquisition, Shockwave Medical’s stock surged, nearing all-time highs as investors reacted positively to the news. The company’s shares were up 1.8% at $325.90, reflecting a year-to-date gain of approximately 70%. In contrast, J&J’s stock remained relatively stable, with a slight decline of around 5% for the year.

Overall, the market response to this deal indicates confidence in J&J’s strategic vision and its ability to capitalize on emerging opportunities in the healthcare sector. By expanding its presence in the cardiovascular intervention market, J&J is positioning itself for long-term success and continued growth.

Conclusion

The acquisition of Shockwave Medical represents a significant milestone for Johnson & Johnson as it seeks to enhance its capabilities in cardiovascular care. With a focus on innovation and patient-centric solutions, J&J is well-positioned to address the evolving needs of individuals with heart-related conditions.

As the transaction moves forward and the integration of Shockwave’s technology progresses, stakeholders will be closely watching to see how J&J leverages this strategic acquisition to drive value for both patients and investors alike. With a strong track record of success and a commitment to advancing healthcare, Johnson & Johnson is poised to make a lasting impact in the cardiovascular intervention market.