The Rise of Delta Air Lines: A Look at Q1 Fiscal 2024 Earnings

Key Takeaways

- Delta is set to report first-quarter earnings on Wednesday, April 10, with investors likely to be watching for key factors like profitability and load factor as the airline works to bring its stock back to pre-pandemic levels.

- Analysts noted that the company’s revenue has largely returned to pre-pandemic levels over the last several quarters, but the stock is still below where it was in 2019.

- Ahead of Delta’s earnings, Morgan Stanley analysts called the airline a top pick for the year, pointing to the air carrier’s push into expanding premium offerings.

Delta Air Lines (DAL) is set to report earnings for the first quarter of fiscal 2024 on Wednesday, just over a week after Morgan Stanley analysts called the airline a top pick for the year, pointing to the air carrier’s push into expanding premium offerings.

The airline is expected to post revenue of $13.14 billion, adjusted net income of $220.5 million, and adjusted earnings per share (EPS) of 34 cents, according to analyst estimates compiled by Visible Alpha. Those numbers would represent year-over-year increases of about 3% in revenue and 35% in profit from the figures that Delta reported in the first quarter of 2023.

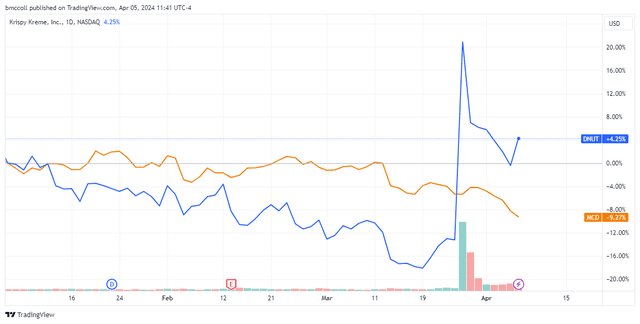

Delta shares, along with those of other airlines and cruise lines, are still recovering from massive pandemic losses. They’ve gained more than 13% so far this year and 37% in the last 12 months, closing Thursday at $45.88, but are still well below their record high of $63.44 set in July 2019, before the pandemic decimated revenue and stock prices across the travel industry.

Morgan Stanley analysts wrote that the company was undervalued, and its current trajectory of shifting to focus on more premium offerings and higher-spend customers could mirror the rise clothing company Abercrombie & Fitch’s (ANF) stock has seen of late, jumping 35% this year and more than quadrupling in value in the last 12 months to $123 as of about noon ET Friday.

The Morgan Stanley analysts raised their price target on Delta stock to $85 from $77 and their “bull case valuation” to $110 from $90, which would be more than double its price midday Friday. Bank of America analysts also expressed optimism about the airline’s earnings in a Thursday note, reiterating a “buy” rating and raising Delta’s price objective to a more conservative $53, up from $50.

| Estimates for Q1 2024 | Q4 2023 | Q1 2023 |

| $13.14 billion | $14.22 billion | $12.76 billion |

| $0.34 | $1.28 | $0.25 |

| $220.5 million | $826 million | $163 million |

Key Metric: Load Factor

Investors will be watching to track Delta’s quarterly load factor, the percentage of available seating capacity that is filled with passengers.

The cost of flying a plane from one destination to another is relatively fixed no matter how full the plane is, so the more seats on a plane an airline can fill, the more profitable each individual flight is. Delta averaged a load factor between 82% and 88% in the two fiscal years before COVID-19, but the statistic dipped to 55% for fiscal 2020 as the pandemic raged.

Delta’s passenger load factor was 81% in the first quarter last year, and reached 88% in the second and third quarters of 2023 before settling at 84% during the busy holiday travel season. If Delta’s load factor remains consistently above 80% in the first quarter and through the rest of this year after reporting 85% for fiscal 2023, investors could see it as a sign that Delta is still on track to return to its pre-pandemic levels of performance.

Load factor across the airline industry in 2023 was 82.3%, putting Delta slightly above average, according to the International Air Transport Association, which tracks load factor and other flight data.

Business Spotlight: Premium Offerings

After Morgan Stanley analysts highlighted the trend earlier this month of Delta’s ongoing shift to more premium offerings and younger, wealthier customers, a key portion of Delta’s earnings report and call could be growth in those categories.

Delta said in last year’s Q1 report that premium product revenue and “diverse revenue streams” had grown to 56% of total adjusted operating revenue, and Morgan Stanley analysts wrote that premium products represented $19 billion of Delta’s 2023 revenue, about 35%.

Among people Morgan Stanley surveyed, those who earned over $150,000 were by far the most likely to say they were planning to travel in the next six months, which also represents the most likely segment to spend more on things like air travel.

Delta’s “premium products” sales rose to $4.02 billion in the first quarter of 2023, compared to $2.54 billion in the same period in 2022, a 58% year-over-year increase.

Read the original article on Investopedia.

By focusing on key metrics like load factor and premium offerings, Delta Air Lines is positioning itself for growth and recovery as it navigates through the challenges brought on by the COVID-19 pandemic. With positive analyst outlooks and a strategic shift towards catering to high-spending customers, Delta’s upcoming earnings report could shed light on its path towards regaining pre-pandemic levels of performance. Investors will be closely monitoring these developments as they assess Delta’s position in the recovering travel industry landscape.