The Surprising Strength of the U.S. Economy: Why Forecasters Keep Getting It Wrong

What You Need to Know

- Forecasters have consistently underestimated how willing U.S. consumers are to spend their money regardless of high prices and interest rates pressuring household budgets.

- Hotter-than-expected consumer spending has kept the economy growing, boosted the job market, and stoked inflation beyond expectations.

- Consumers are apparently not cutting back on things like dining out, defying the expectations built into economic models that people will behave rationally.

The U.S. economy keeps defying expectations. In the past month, employers have added more jobs than forecasters expected, consumers have spent more, the economy has grown more, and businesses have raised prices more. Report after report shows the economy running hotter than expected, with people generally spending more money and doing more stuff than economists thought they would.

While it’s not unusual for economic forecasts to be wrong—predicting the future in any arena is extremely difficult—the forecasts have consistently been off in the same direction, underestimating how willing people have been to part with their money.

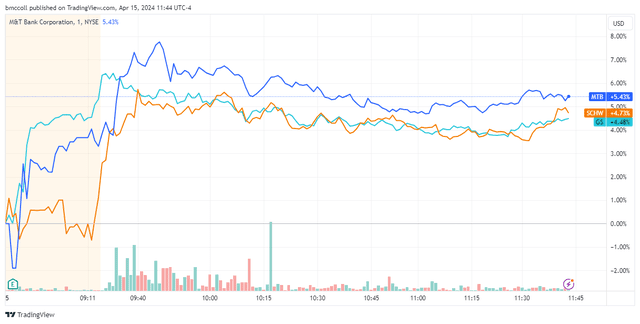

One of the most prominent examples of this phenomenon is inflation. A key monthly inflation report, the Consumer Price Index, came in hotter than expected last week for the third month in a row, sending shockwaves through financial markets as investors are no longer convinced the Federal Reserve will roll back its anti-inflation interest rate hikes any time soon.

The Behavior of Consumers

What are the forecasters missing? It all comes down to the behavior of consumers, said Kurt Rankin, senior economist at PNC Financial Services Group. For example, Rankin’s models predicted that as prices for necessities rose, U.S. consumers would cut back on luxuries like dining out. That would reduce demand at restaurants and cause a key measure of restaurant prices called “food away from home” in the CPI, to fall. Instead, grocery prices have remained relatively stable while prices at restaurants have shot up, suggesting that more people are dining out, budget be damned.

“You can only generate forecasts for inflation based on what rational behavior would dictate,” Rankin told Investopedia. Consumers continue to defy economists’ conventional wisdom by spending through their income and savings as well as accumulating credit card debt without cutting back on spending, Rankin said.

Indeed, data on consumer finances shows people are putting more purchases on plastic to maintain their lifestyles as prices rise. And with interest rates for credit cards at multi-decade highs, alternatives, such as buy-now-pay-later plans, have grown more popular.

And because all of that data is connected—consumer spending can power economic growth as measured by the Gross Domestic Product, which can encourage businesses to hire more, which can stoke inflation—one assumption being off can throw many forecasts out of whack.

“All these things, month after month, are defying economic convention,” Rankin said. “It’s a vicious cycle of one number coming in stronger than expected and then it’s the domino effect, where everything else including inflation consistently overshoots expectations.”

Read the original article on Investopedia.

Conclusion

The surprising strength of the U.S. economy and the resilience of consumer spending have confounded forecasters time and time again. As consumers continue to defy economic models by spending more than expected despite rising prices and interest rates, it is clear that traditional forecasting methods may need to be reevaluated. The interconnected nature of consumer behavior, economic growth, and inflation highlights the complexity of predicting future economic trends. As we navigate these uncertain times, it is essential for economists and policymakers to closely monitor consumer behavior and adapt their forecasting models accordingly.