Okta Shares Surge 23% After Beating Quarterly Estimates

Cloud identity software company, Okta, saw its shares surge 23% in extended trading on Wednesday after the company reported better-than-expected quarterly results and raised its full-year sales outlook. This impressive performance has caught the attention of investors and analysts alike, making Okta a stock to watch in the coming months.

Beating Expectations

Okta reported revenue of $316.5 million for the second quarter, surpassing analysts’ estimates of $296.4 million. The company also reported a non-GAAP profit of $0.11 per share, beating expectations of a loss of $0.01 per share. These strong financial results demonstrate Okta’s ability to deliver value to its customers and drive growth in a competitive market.

Raising Full-Year Sales Outlook

In addition to beating quarterly estimates, Okta also raised its full-year sales outlook. The company now expects revenue to be in the range of $1.24 billion to $1.25 billion, up from its previous guidance of $1.21 billion to $1.23 billion. This upward revision reflects Okta’s confidence in its ability to continue growing its business and expanding its market share.

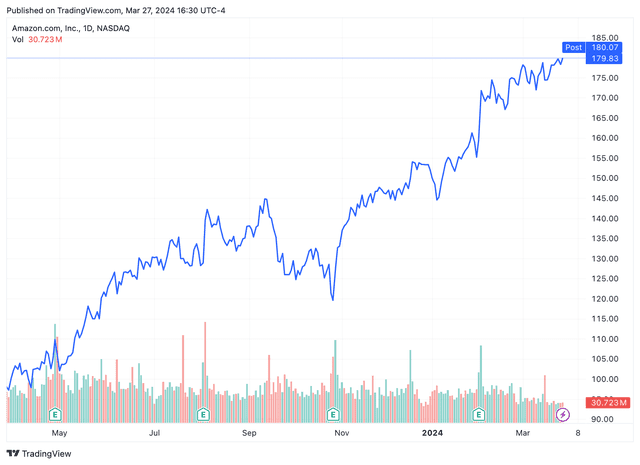

Chart Levels to Monitor

As Okta’s shares continue to soar, it is important for investors to monitor key chart levels to gauge the stock’s performance and potential future movements. By analyzing these levels, investors can make informed decisions about when to buy, sell, or hold Okta shares.

Support Levels

Support levels are price points at which a stock is expected to find buying interest and potentially reverse its downward trend. For Okta, key support levels to monitor include $250, $230, and $210. If the stock falls below these levels, it could indicate a weakening trend and potential further downside.

Resistance Levels

Resistance levels are price points at which a stock is expected to encounter selling pressure and potentially reverse its upward trend. For Okta, key resistance levels to monitor include $300, $320, and $340. If the stock breaks above these levels, it could signal a strengthening trend and potential further upside.

Moving Averages

Moving averages are technical indicators that help investors identify trends and potential entry or exit points for a stock. For Okta, key moving averages to monitor include the 50-day and 200-day moving averages. If the stock remains above these averages, it could indicate a bullish trend, while falling below them could signal a bearish trend.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements. For Okta, an RSI above 70 could indicate that the stock is overbought and due for a correction, while an RSI below 30 could indicate that the stock is oversold and due for a rebound. Monitoring the RSI can help investors identify potential buying or selling opportunities.

In Conclusion

Okta’s impressive performance in the second quarter has propelled its shares to new heights, making it a stock to watch in the coming months. By beating quarterly estimates and raising its full-year sales outlook, Okta has demonstrated its ability to deliver value to customers and drive growth in a competitive market.

As investors continue to monitor Okta’s chart levels, including support and resistance levels, moving averages, and the RSI, they can make informed decisions about when to buy, sell, or hold Okta shares. With its strong financial results and positive outlook, Okta is well-positioned for future success in the cloud identity software industry.