Monitor These Key Chart Levels for Nike Stock

Nike shares will be in focus on Monday following the announcement that the sports apparel and equipment maker plans to lay off 740 employees at its Beaverton, Oregon headquarters by the end of June. This move is part of a three-year cost-cutting plan to reduce expenses by $2 billion, which the company announced in December.

The stock closed Friday at $94.53, and investors will be closely monitoring key chart levels to gauge potential price movements in the coming days and weeks.

Key Takeaways

– Nike shares may find support near a double bottom chart pattern around $89.

– Resistance is expected near a horizontal line at $104.

Nike’s Cost-Cutting Measures

Nike’s vice president for people solutions, Michele Adams, stated in a notice filed on Friday that the company will be permanently reducing its workforce at its World Headquarters as part of a second phase of impacts. This reduction is in line with the company’s broader cost-cutting strategy announced late last year.

The sportswear giant aims to reduce expenses by $2 billion over three years, with job cuts forming a significant part of this plan. In February, Nike announced it would slash 1,600 jobs, or around 2% of its total workforce, due to declining demand for its products. Other cost-reduction measures include product supply adjustments and management restructuring.

Earnings Outlook

On its latest earnings call in March, Nike cautioned that it expects a low single-digit decline in revenue in the first half of its 2025 fiscal year. The company is undergoing a period of transition with its product portfolio, which has led to some uncertainty among investors.

Stock Performance

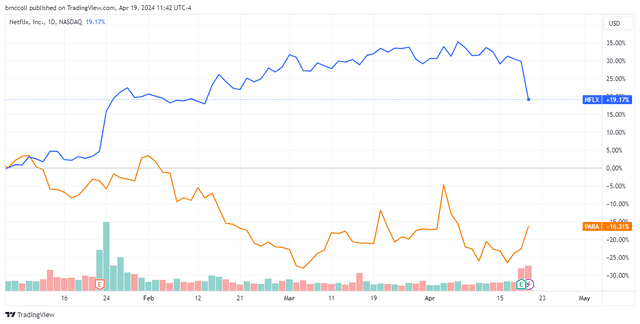

Since the beginning of the year, Nike’s stock has fallen 13%, while the S&P 500 has seen a 4% increase. Analysts have expressed bearish sentiments towards Nike, citing concerns over slowing innovation, inventory backlog, and increased competition in the activewear market.

Chart Analysis

The Nike share price appears to be forming a double bottom pattern, with potential support around $89 based on swing lows from September and April. Investors should watch this level closely during periods of weakness to see if buyers can defend it.

On the upside, the $104 level is likely to act as resistance, as it represents a key horizontal line connecting price action over the past 10 months. A breakout above this level could signal a move towards higher resistance around $115.

Conclusion

Nike’s stock performance will be closely watched in the coming days as investors assess the impact of the company’s cost-cutting measures and its future earnings outlook. Key chart levels at $89 and $104 will play a crucial role in determining the stock’s direction. Stay tuned for updates on Nike’s stock performance as it navigates through these challenging times.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as investment advice. The author does not own any securities mentioned in this article.