The three white soldiers candlestick pattern is a bullish reversal signal that is widely used by traders and analysts. In order to understand this pattern, it is important to first understand the basics of candlestick charts.

Candlestick charts are a type of financial chart used to represent the price movements of an asset, such as a stock or currency. They are composed of individual candles that represent a specific time period, such as a day or an hour. Each candle has a body and two wicks, one at the top and one at the bottom.

The body of the candle represents the opening and closing prices of the asset during that time period, while the wicks represent the highest and lowest prices reached during that time. If the closing price is higher than the opening price, the body of the candle is typically colored green or white. If the closing price is lower than the opening price, the body of the candle is typically colored red or black.

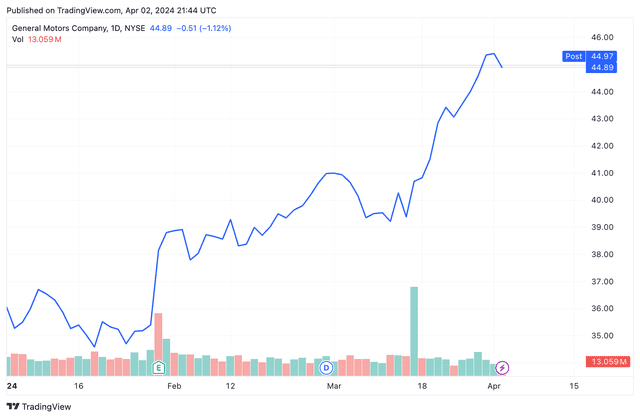

The three white soldiers pattern is a bullish reversal signal that occurs over three consecutive candles. Each candle in the pattern should have a long white body and little to no wick at the top. The opening price of each candle should be within the body of the previous candle, and the closing price should be higher than the previous candle’s closing price.

This pattern indicates that buyers are taking control of the market and pushing prices higher. It is often seen as a sign of strength and can be used by traders as a signal to enter long positions or to add to existing long positions.

However, it is important to note that no trading signal is foolproof and traders should always use other indicators and analysis to confirm their trades. It is also important to consider market conditions and other factors that may impact price movements.

In conclusion, understanding the basics of candlestick charts and the three white soldiers pattern can be a valuable tool for traders and analysts. By recognizing this bullish reversal signal, traders can potentially profit from the upward momentum in the market. However, it is important to always use caution and to consider other factors before making any trades.