The Impact of April’s Job Market Slowdown on the Economy

U.S. employers added fewer jobs than expected in April, breaking a three-month-long streak of hotter-than-expected jobs data. The news sent stocks sharply higher Friday amid investor optimism that a long-awaited cooling of the economy could be on the horizon and prompt the Federal Reserve to cut interest rates.

Job Market Data for April

Employers added 175,000 jobs in April, a slowdown from the upwardly revised 315,000 jobs created in March, the Bureau of Labor Statistics said Friday. That was well below the forecast for 240,000, according to a survey of economists by Dow Jones Newswires and the Wall Street Journal, and was the first time in four months the job data undershot expectations. The unemployment rate edged up to 3.9%, higher than the median forecast for it to stay at 3.8%, but staying close to historic lows.

While the number of jobs added wasn’t especially low by historical standards—the average in the three years before the pandemic was 177,000 jobs a month—it added to gathering signs of weakness. A reduction in job openings over recent months indicates the Federal Reserve’s campaign of interest rate hikes, intended to combat inflation, is dragging on the economy.

A Slowdown That Has Been Slow To Arrive

Economists have long anticipated the downshift, but it has been slow to arrive partly because consumers have accelerated spending despite high prices and interest rates pressuring household budgets. A slower job market in April meant lower pay increases for workers, who had their hourly wages rise 0.2% in April from March, according to the data released Friday.

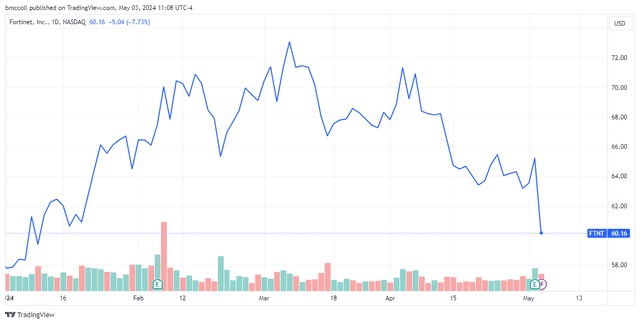

The labor market slowdown worsens the outlook for job seekers but could boost financial markets and provide respite for consumers because of its implications for inflation and interest rates. The Dow Jones Industrial Average was up more than 400 points in early-afternoon trading, while the tech-heavy Nasdaq Composite was up more than 300 points, a nearly 2% gain.

Fed Is Seeking Confidence Inflation Tamed

Officials at the Federal Reserve have kept the central bank’s benchmark interest rate higher for longer, using monetary policy to quell inflation, partly because of the labor market’s surprising winning streak. Slower hiring and wage growth could take upward pressure off price increases, and encourage Fed officials to lower the fed funds rate, which influences rates on all kinds of credit including mortgages and business loans.

The Fed, in deciding Wednesday to leave its key rate at a 23-year high, said that progress had stalled in bringing inflation down to the central bank’s annual 2% target. Fed Chair Jerome Powell said in a press conference after the decision was announced that, while he’s less confident about inflation’s downward trajectory based on recent data, he still thinks it’s likely to fall.

According to Danielle Hale, chief economist at Realtor.com, “(t)he April jobs report came in at a healthy level, but much more in line with the cooling that the Fed is looking for, consistent with the idea that their monetary policy is working to rein in economic growth and ease inflation.”

“This month’s data shows that the labor market remains relatively healthy, even as it indicates that momentum is slowing, falling more in line with what is expected at this point in the monetary policy cycle,” Hale said in a commentary.

Conclusion

The slowdown in the job market for April has significant implications for both investors and consumers. While it may signal a cooling of the economy and prompt the Federal Reserve to cut interest rates, it also has the potential to ease inflationary pressures and provide relief for borrowers.

As investors react positively to the news of a slower job market, it remains to be seen how the Federal Reserve will respond in terms of monetary policy adjustments. The coming months will be crucial in determining the overall economic trajectory and how various sectors will be impacted by these changes.

Overall, while a slowdown in job creation may initially raise concerns, it could ultimately lead to a more balanced and sustainable economic environment in the long run.

Read the original article on Investopedia.