ExxonMobil Completes Nearly $60B Pioneer Deal: What You Need to Know

Key Takeaways

- ExxonMobil said it completed its deal to buy Pioneer Natural Resources valued at nearly $60 billion after U.S. regulators set conditions.

- Including debt, ExxonMobil is committing about $64.5 billion to the purchase of Pioneer.

- Pioneer CEO Scott Sheffield was barred from joining ExxonMobil’s board in order to meet Federal Trade Commission conditions.

- The acquisition is expected to more than double ExxonMobil’s production volume in the key Permian Basin oil field.

ExxonMobil (XOM) said Friday it completed its deal to buy Pioneer Natural Resources valued at nearly $60 billion after getting approval from U.S. regulators. Including debt, ExxonMobil is committing about $64.5 billion to the purchase of Pioneer.

FTC Approval Won as Pioneer CEO Scott Sheffield Barred From Board

The Federal Trade Commission (FTC) had challenged the deal over concerns that as part of ExxonMobil’s board, Pioneer CEO Scott Sheffield could be involved in “collusive activity that would potentially raise crude oil prices, leading American consumers and businesses to pay higher prices for gasoline, diesel fuel, heating oil and jet fuel.” It accused Sheffield of trying to “align production across the key Permian Basin oil field in West Texas and New Mexico with OPEC+.” Officials required that in order to get approval for the acquisition, Sheffield could not hold a board position.

Deal To More Than Double ExxonMobil’s Permian Basin Production

ExxonMobil said the merger would more than double its Permian Basin production volume to 1.3 million barrels of oil equivalent per day (MOEBD) based on last year’s volumes, and it expects that to rise to about 2 MOEBD in 2027.

ExxonMobil CEO Darren Woods said adding Pioneer gives the company “a greater opportunity to deploy our technology and deliver operating and capital efficiency for long-term shareholder value.”

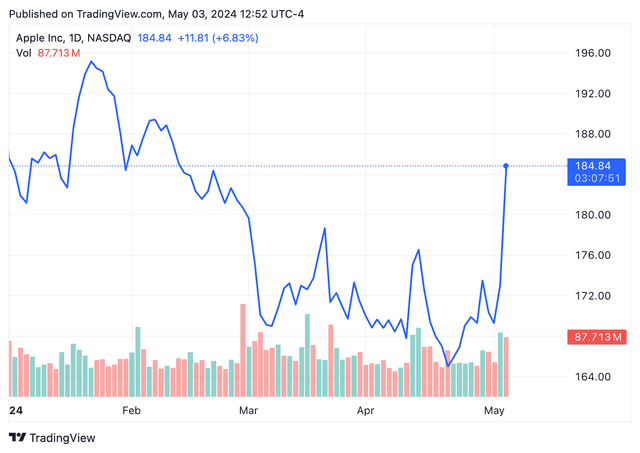

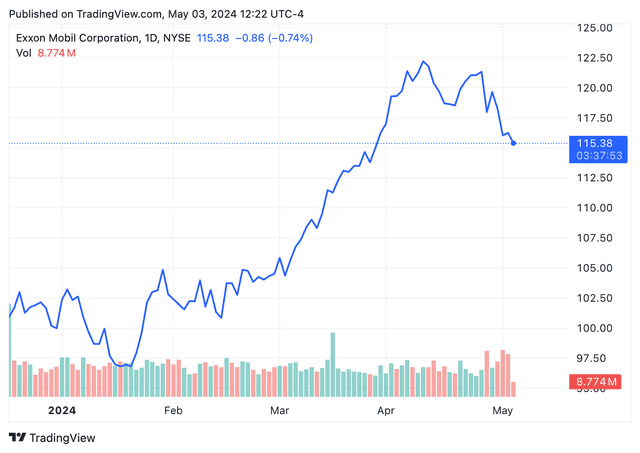

Shares of ExxonMobil were down 0.7% at $115.38 as of 12:20 p.m. ET Friday, but have gained more than 15% so far this year.

Conclusion

The completion of the nearly $60 billion deal between ExxonMobil and Pioneer Natural Resources marks a significant milestone in the energy industry. With the acquisition expected to more than double ExxonMobil’s production volume in the Permian Basin, the company is poised for significant growth in the coming years.

While the deal faced challenges from U.S. regulators over concerns of collusive activity, the Federal Trade Commission’s approval with conditions ensures that competition in the market is maintained. By barring Pioneer CEO Scott Sheffield from joining ExxonMobil’s board, regulators aim to prevent any potential anti-competitive behavior that could harm consumers and businesses.

ExxonMobil’s CEO Darren Woods expressed optimism about the merger, highlighting the opportunities it presents for deploying technology and improving operational efficiency for long-term shareholder value. Despite a slight dip in share price following the announcement, ExxonMobil’s stock has shown strong performance throughout the year.

Overall, the completion of this deal underscores ExxonMobil’s commitment to strategic growth and innovation in the energy sector. As the company looks towards the future, investors and industry observers will be closely watching how this acquisition shapes ExxonMobil’s position in the market and its ability to drive value for shareholders.

Read the original article on Investopedia.