How High Mortgage Rates Are Impacting Home Sales in the U.S.

Key Takeaways:

- About 50 million active mortgages in the U.S. have fixed interest rates much lower than current market rates, leading to a decrease in home sales.

- A new study from the Federal Housing Finance Agency found that for every percentage point that current mortgage rates exceed a homeowner’s interest rate, their probability of selling their house decreases by 18.1%.

- As a result of this mortgage rate “lock-in” effect, there were 1.33 million fewer home sales between the second quarter of 2022 and the fourth quarter of 2023.

- Despite the impact of high mortgage rates, some homeowners have started putting their homes on the market, signaling a shift in behavior.

High mortgage rates in the U.S. are having a significant impact on the housing market, with many homeowners opting to stay put rather than sell their homes. A new study from the Federal Housing Finance Agency revealed that approximately 50 million active mortgages in the country have fixed interest rates that are much lower than the current market rates. This discrepancy has led to a decrease in home sales, with 1.33 million fewer sales recorded between the second quarter of 2022 and the fourth quarter of 2023.

The Lock-In Effect of Mortgage Rates

According to the study, for every percentage point that current mortgage rates exceed a homeowner’s interest rate, their likelihood of putting their house up for sale decreases by 18.1%. This phenomenon, known as the mortgage rate “lock-in” effect, has caused many existing borrowers to refrain from selling their homes. With current mortgage rates hovering around 7%, homeowners would have to pay an average of $511 more per month for the same loan amount, making it financially unfeasible for many to sell their homes.

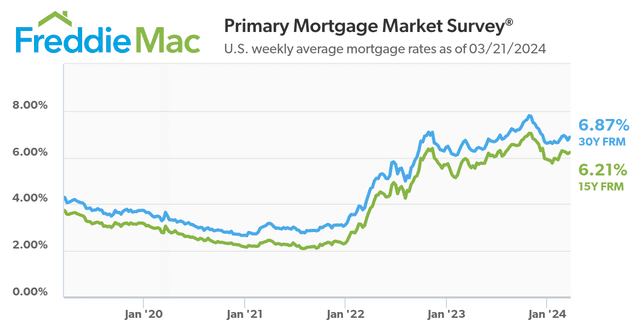

The chart above illustrates the trend in mortgage rates over the past five years, highlighting the significant increase in rates since the Federal Reserve began raising its fed funds rate to combat inflation. As a result, mortgage rates have more than doubled, further exacerbating the challenges faced by homeowners looking to sell their properties.

A Shift in Homeowner Behavior

Despite the lock-in effect of high mortgage rates, recent data from the National Association of Realtors (NAR) suggests that some homeowners have started putting their homes on the market. In February, 1.07 million homes were listed for sale, marking the highest number for any February since 2020. NAR economist Lawrence Yun noted that homeowners who had been delaying selling their homes due to low interest rates can no longer afford to wait.

Yun stated, “Maybe consumers are accepting the new normal,” indicating a shift in homeowner behavior as they adapt to the current market conditions. This change in mindset could potentially lead to an increase in home sales in the coming months as more homeowners decide to take advantage of the strong demand in the housing market.

Conclusion

High mortgage rates in the U.S. have created a challenging environment for homeowners looking to sell their properties. The lock-in effect of low fixed interest rates has deterred many from putting their homes on the market, leading to a decrease in home sales. However, recent data suggests that some homeowners are starting to shift their behavior and list their homes for sale, signaling a potential change in the housing market landscape.

As mortgage rates continue to fluctuate, it will be crucial for homeowners to carefully consider their options and make informed decisions about selling their properties. By staying informed about market trends and seeking guidance from real estate professionals, homeowners can navigate the current challenges and make strategic choices that align with their financial goals.

For more information on this topic, please visit Investopedia.