The Lucid Electric Vehicle Maker Receives $1 Billion Cash Injection

Key Takeaways:

- Lucid shares surged over 5% Monday after the electric vehicle maker announced a $1 billion injection of cash from its biggest shareholder through a private stock sale.

- Lucid said the money from an affiliate of Saudi Arabia’s Public Investment Fund would be used for general corporate purposes.

- Despite Monday’s gains, Lucid shares have lost nearly 30% of their value so far in 2024.

Lucid (LCID) shares jumped over 5% Monday after the electric vehicle (EV) manufacturer announced an injection of cash from its biggest shareholder through a $1 billion purchase of newly created convertible preferred stock.

The maker of the Lucid Air sedan said the sale to Ayar Third Investment Company, an affiliate of Saudi Arabia’s Public Investment Fund (PIF), would be done in a private placement.

The company said that it planned to use the cash for general corporate purposes, which may include capital expenditures and working capital, among other things.

CEO and CTO Peter Rawlinson said that PIF’s support is “a key differentiator” in Lucid’s ability to invest for the long term in both its technology and production capabilities. He added that with PIF’s financial backing, the car maker remains “focused upon accelerating our growth via deliveries, executing key business initiatives with relentless focus upon cost, and launching our game-changing Gravity SUV later this year.”

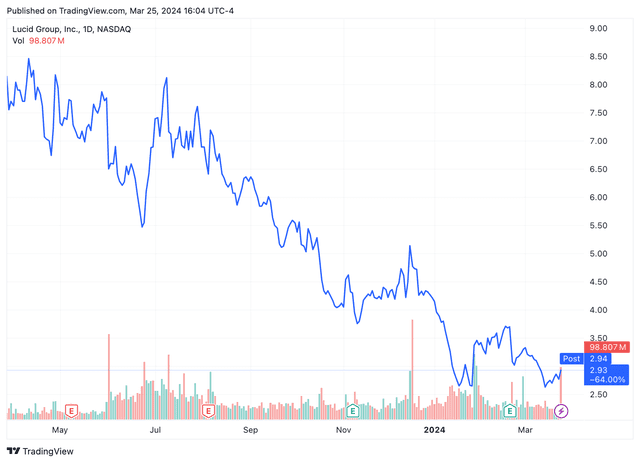

Shares of Lucid finished 5.4% higher at $2.92 Monday following the news. Despite Monday’s gains, Lucid shares have lost nearly 30% of their value so far in 2024 and over 64% over the past 12 months.

Read the original article on Investopedia.

What Does This Cash Injection Mean for Lucid?

The $1 billion cash infusion from Saudi Arabia’s Public Investment Fund comes as a significant boost for Lucid, especially amidst a challenging market environment for electric vehicle manufacturers. The funds will provide Lucid with the necessary resources to invest in its technology, production capabilities, and overall growth strategy.

With the financial backing of PIF, Lucid can now accelerate its plans for expanding its product lineup, increasing production capacity, and entering new markets. The company’s upcoming launch of the Gravity SUV later this year is highly anticipated, and the additional funding will help ensure a successful rollout.

Market Response and Future Outlook

The positive market response to the news of the cash injection is evident in Lucid’s share price increase on Monday. Investors seem to view the investment from PIF as a vote of confidence in the company’s long-term prospects and growth potential.

Despite the recent gains, Lucid’s shares have faced significant volatility in 2024, with a notable decline in value. However, the infusion of $1 billion in cash could help stabilize the company’s financial position and support its efforts to regain market confidence.

Looking ahead, Lucid will need to focus on executing its business initiatives with precision, managing costs effectively, and delivering on its promises to investors and customers. The success of the Gravity SUV launch will be a key milestone for the company and could have a significant impact on its future performance.

Conclusion

The $1 billion cash injection from Saudi Arabia’s Public Investment Fund represents a major milestone for Lucid and underscores the company’s commitment to long-term growth and innovation in the electric vehicle market. With the support of PIF, Lucid now has the financial resources needed to pursue its strategic objectives and solidify its position as a leading player in the industry.

While challenges remain, including market volatility and competitive pressures, Lucid’s focus on technology, quality, and customer experience will be critical in driving its success moving forward. The upcoming launch of the Gravity SUV will be a key test for the company’s ability to deliver on its promises and capture market share in a rapidly evolving industry.

Overall, the $1 billion cash infusion is a positive development for Lucid and sets the stage for an exciting period of growth and expansion for the company.