UK house prices dropped by 1.1% in the year to February, according to Nationwide Building Society. This was the first annual fall in property values since November 2012, as higher mortgage rates and living costs made homes less affordable. Prices also decreased on a monthly basis, falling by 0.5% from January. The average property is now valued at £257,406, down from £258,297 in January.

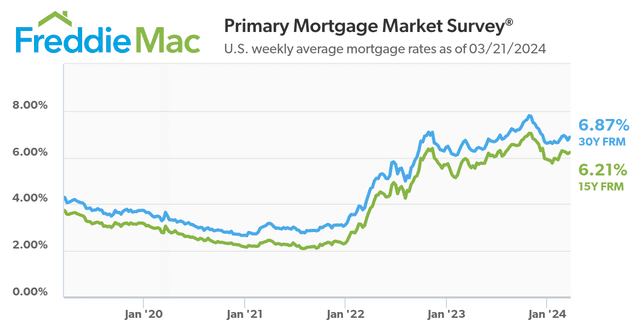

Mortgage rates have been rising since 2021, when the Bank of England increased interest rates to tackle the rising cost of living. Rates spiked to around 6% after Liz Truss’s mini-Budget in September, but have since fallen back. They remain far above the lows seen in late 2021.

Nationwide’s chief economist Robert Gardner said it would be “hard for the market to regain much momentum in the near term” due to economic headwinds. He predicted property prices would fall by 5-6% from their peak in August 2022 to the trough, which he described as a “relatively soft landing given the pressure on household finances”.

House prices have been decreasing for six months in a row, as higher borrowing costs have put pressure on buyers. This has been compounded by the pandemic, which has caused economic uncertainty and weakened the labour market.

Overall, UK house prices are still far higher than they were before the pandemic, but with mortgage rates remaining high and economic headwinds continuing, it is likely that prices will continue to fall in the near future.